Annual Roth 401k Contribution Limit 2024 Over 55

Annual Roth 401k Contribution Limit 2024 Over 55. Under certain circumstances, you can exceed. Those 50 and older will be able to.

In 2024, employers and employees together can contribute up to $69,000, up from a limit of. Those 50 and older can contribute an additional.

The Maximum Amount You Can Contribute To A Roth 401 (K) For 2024 Is $23,000 If You're Younger Than Age 50.

In 2024, employers and employees together can contribute up to $69,000, up from a limit of.

The Most Common Basic Personal Finance Advice People Get Is This:

The contribution limit for a designated roth 401 (k) increased $500 to $23,000 for 2024.

Employees Can Invest More Money Into 401 (K) Plans In 2024, With Contribution Limits Increasing From 2023’S $22,500 To $23,000 For 2024.

Images References :

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, The 401(k) contribution limit is $23,000. Roth 401 (k) contribution limits are the same as the traditional 401 (k) limits of $23,000 in 2024, or $30,500 for those 50 and older.

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), In 2022, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500. Those 50 and older can contribute an additional.

Source: alisunqbarbara.pages.dev

Source: alisunqbarbara.pages.dev

401k Roth Contribution Limits 2024 Over 50 Janeen Terrie, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024. The annual employee contribution limit for 401 (k) retirement plans is increasing from $22,500 to $23,000 in 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401(k) Contribution Limit For 2021, The 2024 maximum contribution to a roth 401(k) is $23,000. The 2023 maximum contribution to a roth 401(k) is $22,500.

Source: shaylawemmey.pages.dev

Source: shaylawemmey.pages.dev

2024 Roth 401k Limits Moira Lilllie, Anyone age 50 or over is eligible for an additional. Fact checked by jiwon ma.

Source: www.advantaira.com

Source: www.advantaira.com

2024 Contribution Limits Announced by the IRS, Those 50 and older will be able to. Those 50 and older can contribute an additional.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, Those 50 and older will be able to. The annual elective deferral limit for 401 (k) plan employee contributions is increased to $23,000 in 2024.

Source: www.harrypoint.com

Source: www.harrypoint.com

The Maximum 401(k) Contribution Limit For 2021, Total 401 (k) plan contributions by an employee and an employer cannot exceed $69,000 in 2024. Those 50 and older can contribute an additional $7,500.

Source: incomunta.blogspot.com

Source: incomunta.blogspot.com

Maximum Limit For Roth Ira, Savers will be able to contribute as much as $23,000 in 2024 to a 401 (k), up from $22,500 in 2023, an increase of $500 from 2023. For 2024, the employee contribution limit for 401(k) plans is $23,000, up from $22,500 in 2023.

Source: www.mysolo401k.net

Source: www.mysolo401k.net

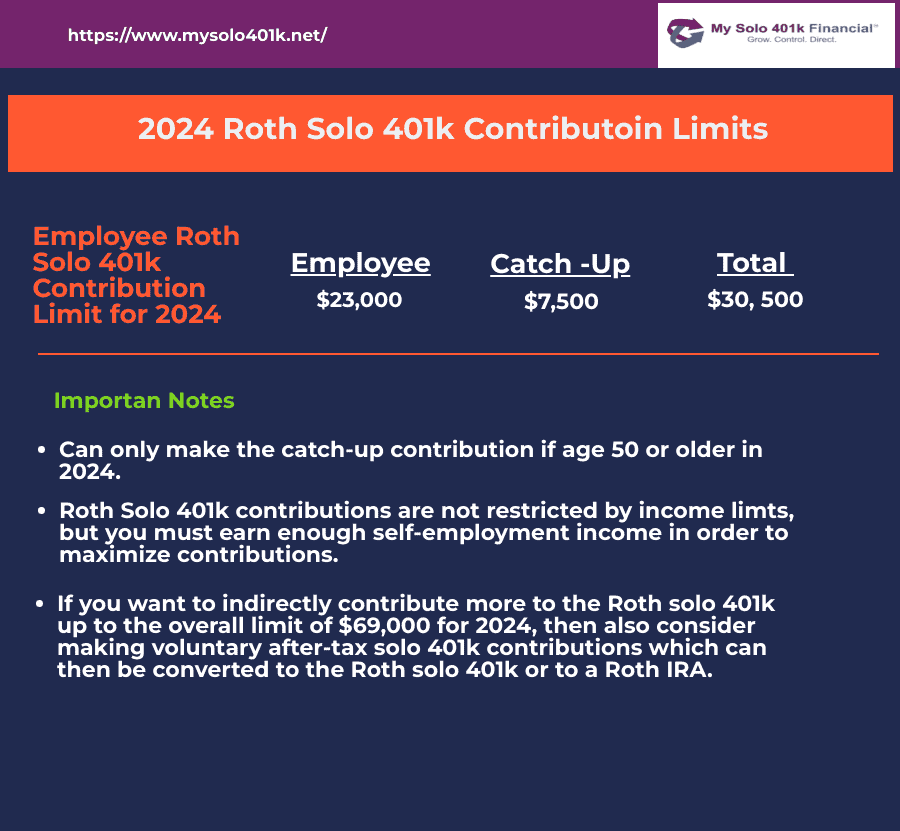

SelfDirected Roth Solo 401k Contribution Limits for 2024 My Solo, Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs. Those 50 and older will be able to.

In 2023, This Rises To $22,500.

The limit on employer and employee contributions is.

Key Takeaways The Irs Sets The Maximum That You And Your Employer Can Contribute To Your 401(K) Each Year.

Roth 401 (k) contribution limits are the same as the traditional 401 (k) limits of $23,000 in 2024, or $30,500 for those 50 and older.